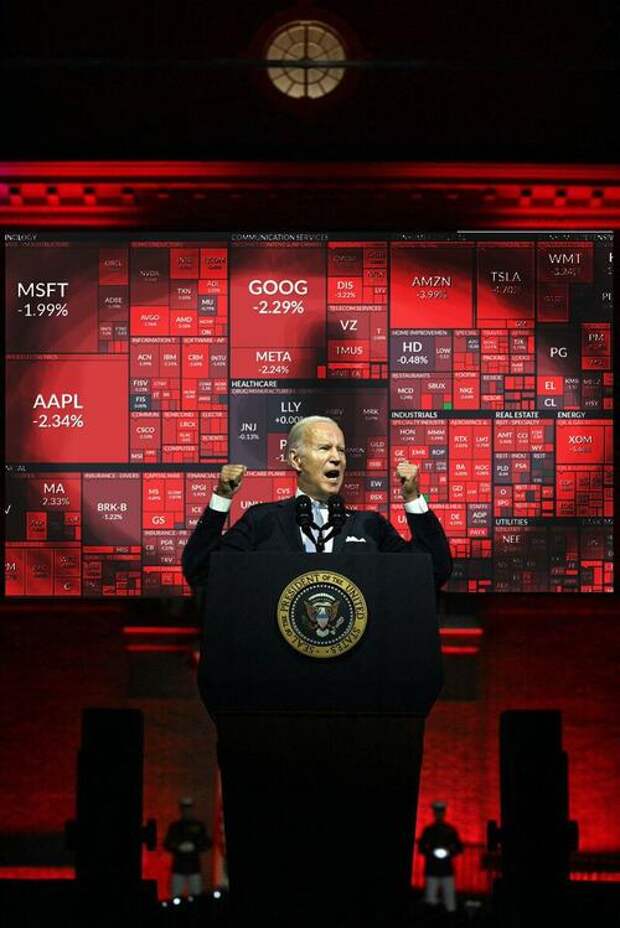

No cute videos today, just one photo summarizes the absolute carnage today, this week, this month and this year.

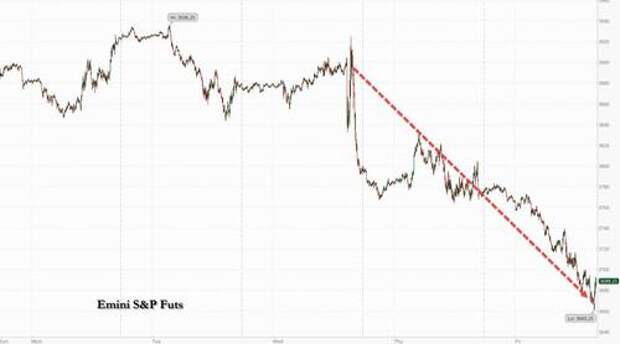

A week that started off with a huge chip on its shoulder after last week's dramatic post-CPI plunge, and which was the worst since June, only got worse, as stocks tumbled a jarring 5% this week, which together with last week's 4.7% means that in just the past two weeks the S&P has lost 10% of its value (it could have been worse if spoos had not bounced modestly off their June, and YTD, lows of 3,660).

And while the catalyst for the plunge is clear - and as highlighted on the chart below it was all about the unexpectedly hawkish FOMC meeting on Wednesday where the 2024 dot came in at 4.6%, hotter than even the biggest hawks had expected - the result was a non-stop liquidation scramble as Powell finally made it clear that he will keep hiking well into the recession and beyond.

To be sure, we've had powerful selloffs before in 2022, but today was the first time since June that the VIX finally spiked above 30. For it to achieve that when everyone in the institutional community is super-hedged with puts, is certainly remarkable.

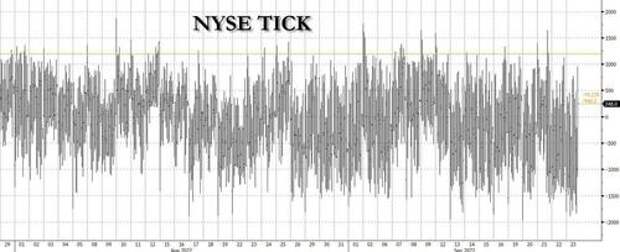

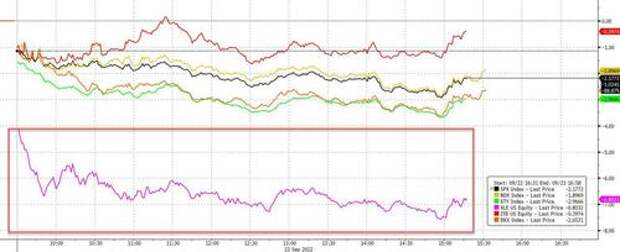

Today's selloff was so broad-based and uniform that not only was everything deep red...

... but TICK barely made it above 0.

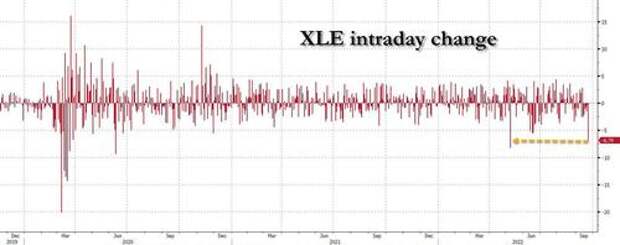

While everything was red, not every sector was pummeled equally - energy stuck out like a sore thumb....

... and the XLE plunged by almost 7%, its second biggest drop since May 9, when oil unexpectedly crashed in what appeared like a government-mandated intervention.

Today's plunge in energy was driven not only by the now-certainty of a looming recession - even as most energy stocks now trade as if oil was priced in the low $50 - but also by the sudden collapse in the price of oil, which saw WTI tumble below $80 for the first time since January, and on pace to lose all of 2022's gains!

The plunge in oil was also a direct result of the now laughably exponential surge in the US dollar, where one look at the Bloomberg dollar index - where the USD is hitting new record highs every single day - shows all one needs to know.

It wasn't just the Fed's tightening plans that were behind the relentless surge in the dollar, which alone were enough to push the market's pricing of the May Fed Funds rate to a whopping 4.7%...

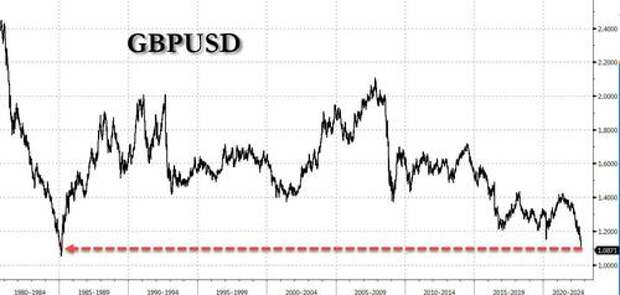

... there was another key catalyst: today's "mini budget" unveiled by the Liz Truss cabinet in the UK, which proposed the biggest tax cuts since the 1970s funded mostly with new debt sales, sent both gilts and the cable crashing...

... with the former tumbling to 1.0872, or levels not seen since February 1985. And with whispers of parity getting louder, it's only a matter of time before we test new record lows for the british currency.

While it was sterling that stole the currency spotlight today, yesterday it was the yen's turn, as the Japanese currency plunged after the BOJ affirmed it will keep buying billions in bonds for years to protect YCC, only to then turn around and intervene in the FX market for the first time since 1998, selling an unknown amount of dollars in the tens of billions for an intervention that has barely achieved anything at all!

Of course, the FX fireworks also meant lots of excitement in the US bond market, where the 10Y yield today briefly spiked to the highest level since April 2010, when it touched a high of 3.8248% before retracing most of the move.

And as the 10Y yield keeps rising, so does the real 10Y, which just hit 1.32%, well above the 2018 highs when the Fed was forced to pivot. And since the fwd P/E tracks the real rate, this suggests there is much more downside for stocks as the following chart shows.

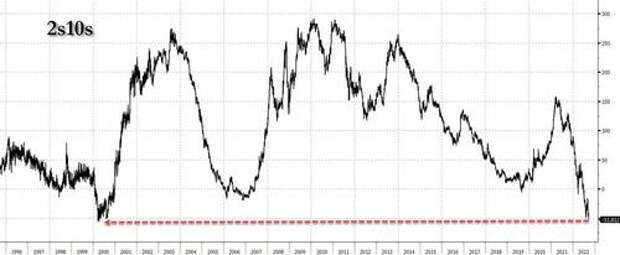

Meanwhile, the 2Y remains sticky, and is now trading around 4.20%, which means that the 2s10s is now inverted some -52bps...

... and just shy of a new record inversion, one which screams not recession but full-blown depression.

And speaking of the coming depression, remember, the Fed won't stop until it breaks something...

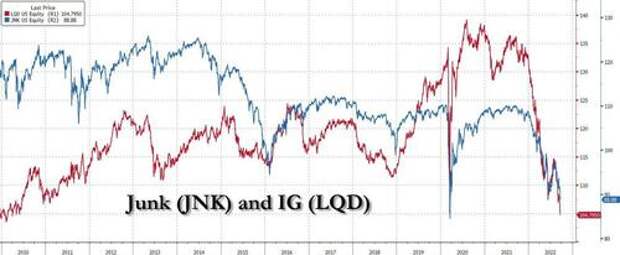

... and after this week there are so many more things that "something" can be: Japan, the UK (which may be locked out of the market sooner even than Italy), as well as things closer to home such as Junk bonds or even Investment Grade securities: don't look now, but the LQD just took out its March 2020 covid crash lows when the Fed stepped in to bail out corporate debt by buying it directly...

... or maybe it will be a certain bank again that catalyzes the next crash...

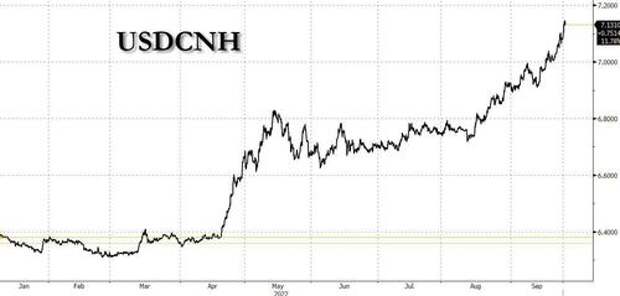

... or just maybe the next mega-crash will be the 640 trillion yuan panda in the room.

And until we wait, well... there's always Joe Biden's "greatest recovery ever"...

Inflation may be at a 40 year high, but at least housing is imploding, the market is crashing, the world is in a global recession and 2 seconds after the midterms the BLS will find a missing folder with 10 million unemployed workers pic.twitter.com/rJY62r2e2s

— zerohedge (@zerohedge)